Portsmouth Va Real Estate Assessment

Appeals & Notices Portsmouth, VA

Appeals & Notices - The valuation of a property may only be discussed with the property owner or a duly authorized agent for the owner. - In the case of a representative of the owner requesting an informal or formal review, an original signed Letter of Authorization or Power of Attorney, granted by the property owner, is required.

https://www.portsmouthva.gov/164/Notices-Appeals

13News Now - YouTube

13News Now (WVEC) is made up of storytellers, innovators, content creators, and idea generators. We stand for passion. Passion for our people, passion in our product, and above all- passion in our community. We value honesty, accuracy, and solutions. We serve as the local ABC affiliate for Hampton Roads.

https://www.13newsnow.com/article/money/2026-property-tax-assessments-explained-what-homeowners-need-to-know/291-16c72d34-83ac-482f-be1c-b494a154af43

an ordinance to provide taxpayers with real estate tax

... 2026, and real estate taxes will be levied and collected for the fiscal year based on that assessment; and. WHEREAS, assessments of real ...

https://www.portsmouthva.gov/DocumentCenter/View/16868/25-126h-OrdinanceCITY OF PORTSMOUTH, VA

NOTE: The proposed FY 2026 Operating Budget as submitted to the City. Council maintains the FY 2025 real property tax rate of $1.30 per $100 of.

https://www.portsmouthva.gov/DocumentCenter/View/16859/25-125-Public-hearingTax Structure in Portsmouth Portsmouth Economic Development

The Real Proof We Want Your Business Portsmouth’s tax structure favors new and expanding businesses. Both state and local tax rates are modest, with credits and other incentives available to many companies. Portsmouth’s tax structure favors new and expanding businesses. Both state and local tax rates are modest, with credits and other incentives available to many companies.

https://www.accessportsmouthva.com/info-hub/tax-structure/

Access to this page has been denied

PORTSMOUTH, Va. (WAVY) – Help may be on the way after ... Virginia reports third measles case in 2026 · Smithfield Foods to buy ...

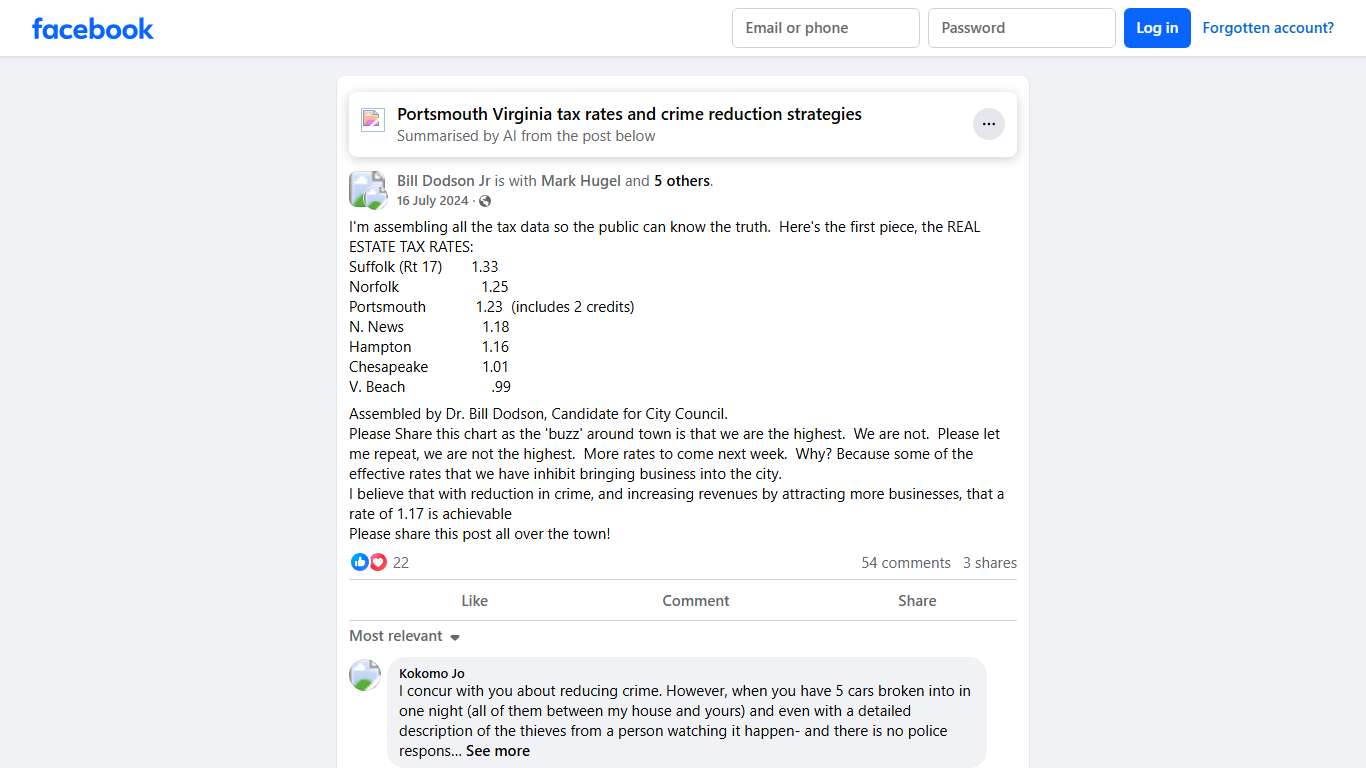

https://www.wavy.com/news/local-news/portsmouth/after-jump-in-real-estate-assessments-as-high-as-40-portsmouth-considers-relief/Voices of Portsmouth, VA I'm assembling all the tax data so the public can know the truth Facebook

I'm assembling all the tax data so the public can know the truth. Here's the first piece, the REAL ESTATE TAX RATES: Suffolk (Rt 17) 1.33 Norfolk 1.25 Portsmouth 1.23 (includes 2 credits) N. News 1.18 Hampton 1.16 Chesapeake 1.01 V.

https://www.facebook.com/groups/VOICESOFPORTSMOUTHVA/posts/7946909315371416/

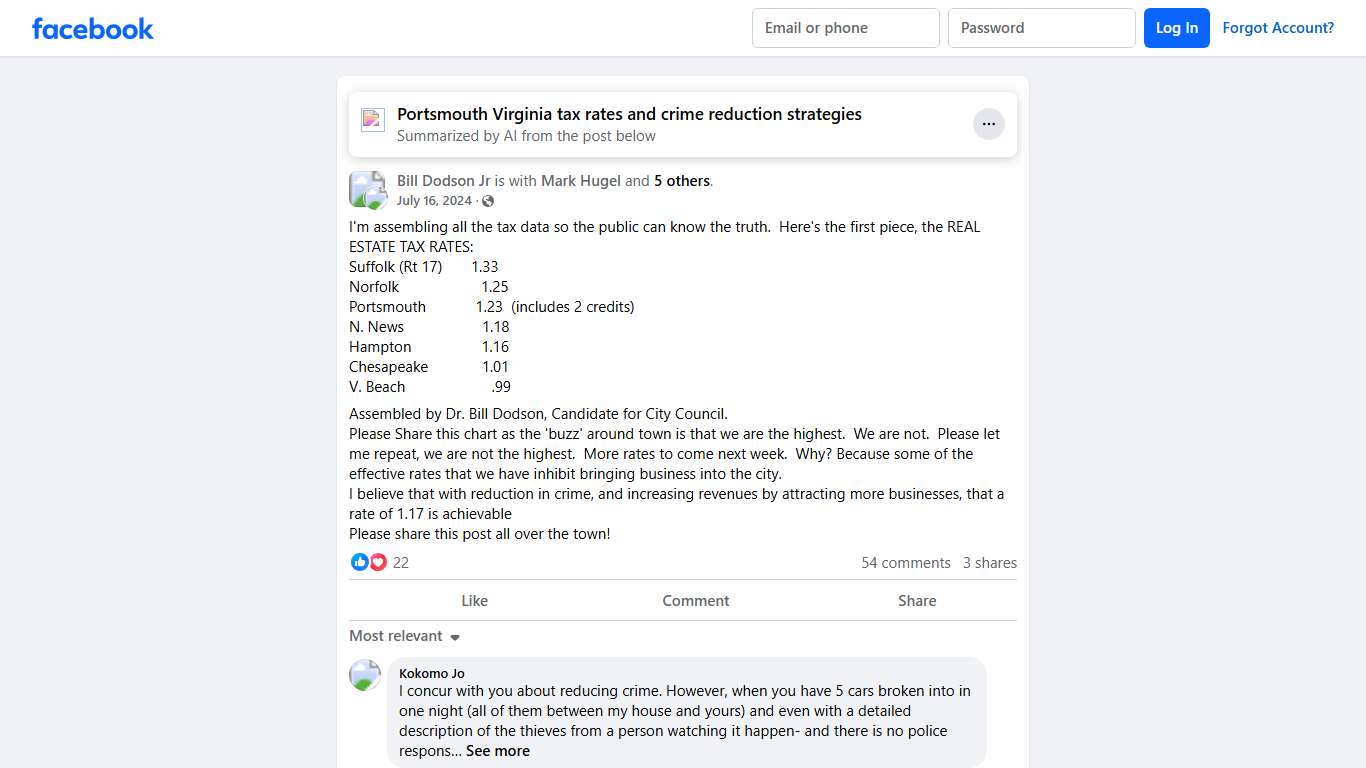

Voices of Portsmouth, VA I'm assembling all the tax data so the public can know the truth Facebook

I'm assembling all the tax data so the public can know the truth. Here's the first piece, the REAL ESTATE TAX RATES: Suffolk (Rt 17) 1.33 Norfolk 1.25 Portsmouth 1.23 (includes 2 credits) N. News 1.18 Hampton 1.16 Chesapeake 1.01 V.

https://www.facebook.com/groups/VOICESOFPORTSMOUTHVA/posts/7946909315371416/

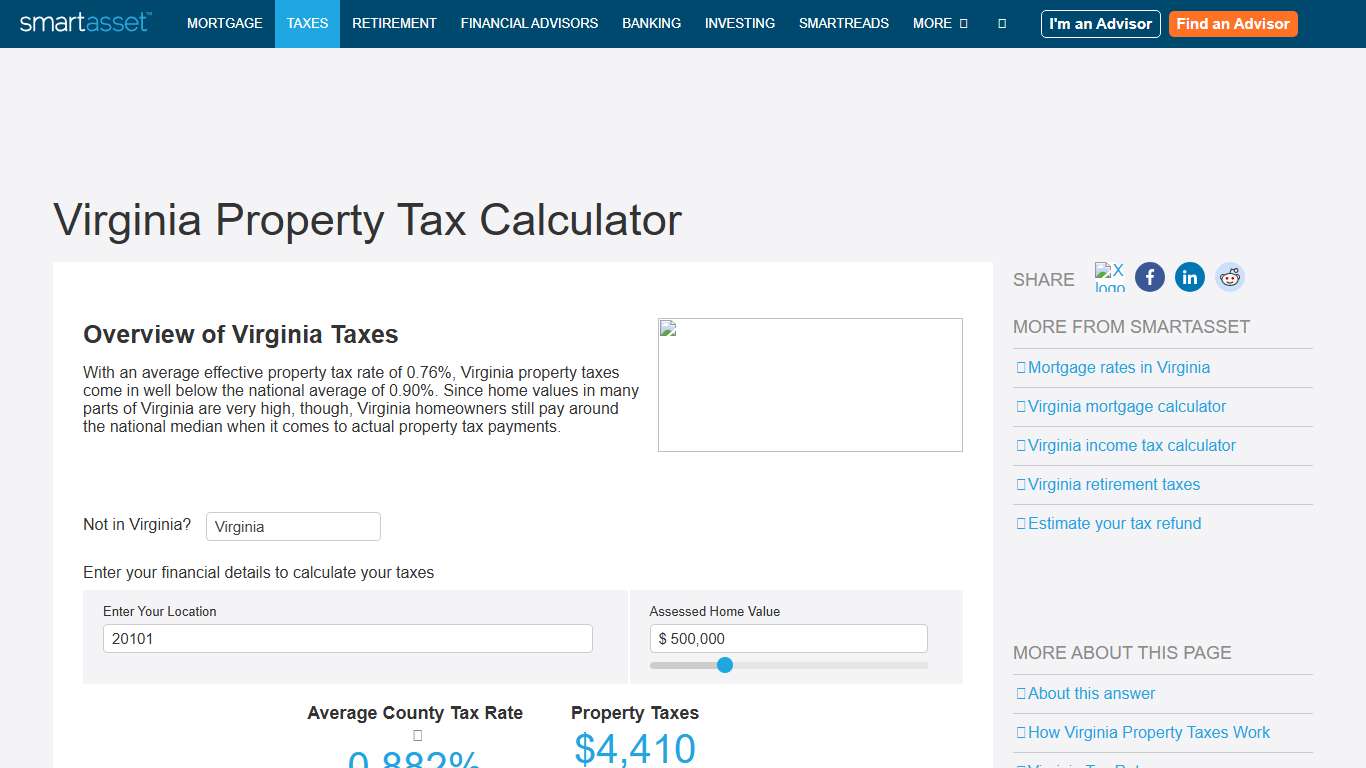

Virginia Property Tax Calculator - SmartAsset

Overview of Virginia Taxes With an average effective property tax rate of 0.76%, Virginia property taxes come in well below the national average of 0.90%. Since home values in many parts of Virginia are very high, though, Virginia homeowners still pay around the national median when it comes to actual property tax payments.

https://smartasset.com/taxes/virginia-property-tax-calculator

2026 Portsmouth, Virginia Sales Tax Calculator & Rate – Avalara

Portsmouth sales tax details The minimum combined 2026 sales tax rate for Portsmouth, Virginia is 6.0%. This is the total of state, county, and city sales tax rates. The Virginia sales tax rate is currently 4.3%. The Portsmouth sales tax rate is 1.0%.

https://www.avalara.com/taxrates/en/state-rates/virginia/cities/portsmouth.html

Portsmouth, Portsmouth County, Virginia Property Taxes - Ownwell

Portsmouth, Portsmouth County, Virginia Property Taxes Median Portsmouth, VA effective property tax rate: 1.25%, significantly higher than the national median of 1.02%, but lower than the Virginia state median of 0.89%. Median Portsmouth, VA home value: $208,665 Median annual Portsmouth, VA tax bill: $2,610, $210 higher than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/virginia/portsmouth-county/portsmouth

Virginia SCC - Forms and Fees

Most forms and fees can be processed online. Paper submissions do not qualify for expedited services. Visit Online Expedited Services to learn more.

https://www.scc.virginia.gov/businesses/forms-and-fees/